Management Discussion And Analysis

Manufactured Capital

Manufactured Capital

Sampath Bank’s manufactured capital comprises the Property, Plant and Equipment of the Bank. Manufactured capital is key to connecting with customers as we seek to support and enhance economic activities throughout the country.

With the growth of digital transaction platforms and volumes, the need to be in every economic centre of activities has waned. A mature island-wide footprint supports our ability to service customers and preserves visibility in key markets. Consequently, the Bank has not increased the number of branches during the year, opting to invest in enhancing its digital capital which effectively supports the branch network.

| Strategic Priorities 2024 | Key Achievements in 2024 | Priorities for 2025 | UN SDG |

|---|---|---|---|

| Improve the digital experience for customers at branches and at ATMs, CDMs, CRMs and VTMs | Introduced over 140 new CRMs, either replacing existing ATMs or as additions to the current network, including three strategic locations | The Bank plans to invest in around 200 new CRMs, replacing ATMs and CDMs while enhancing self-service options like cash withdrawals, deposits, recycling, balance enquiries, and account management |

|

| Upgrading and enhancing existing branches | Major changes or upgrades made to 30+ branches | Major refurbishments to be made to 50+ branches |

|

| Upgrading the Bank’s head office owned by its subsidiary, Sampath Centre Limited | As outlined on pages 142 to 146 in the ‘Subsidiary Performance’ report |

|

|

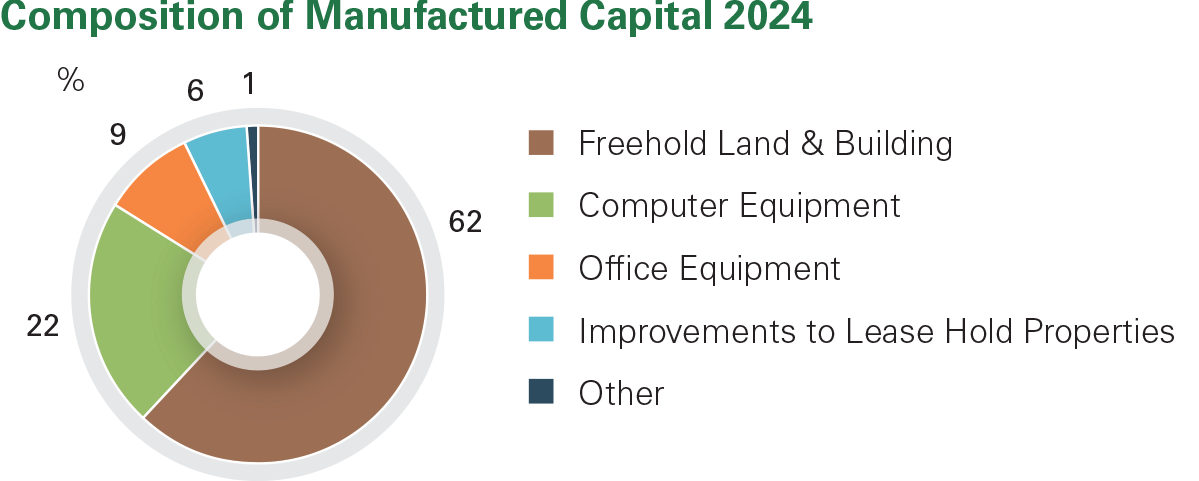

The chart represents the Bank’s total property, plant, and equipment as of the year-end 2024. The total value of these assets amounts to Rs 10.9 Bn, with Freehold Land and Buildings accounting for 62%, Computer Equipment for 22%, Office Equipment for 9%, Improvements to Leasehold Properties for 6%, and Others for 1%.

2,300+

Physical Customer Touch Points

Rs 2.2 Bn

Investment in Manufactured Capital during 2024

3

Premises Converted to Solar Rooftops in 2024

MANUFACTURED CAPITAL FOOTPRINT

Branches

Branches229

Automated Teller Machines (ATMs)

Automated Teller Machines (ATMs)260

Cash Recycling Machines (CRMs)

Cash Recycling Machines (CRMs)295

Cash Deposit Machines (CDMs)

Cash Deposit Machines (CDMs)234

eZ Banking Agents (EBAs)

eZ Banking Agents (EBAs)1,252

Digital Banking Centres (DBCs)

Digital Banking Centres (DBCs)32

Scan this QR code for more details on the Bank's Physical Customer Touch Points

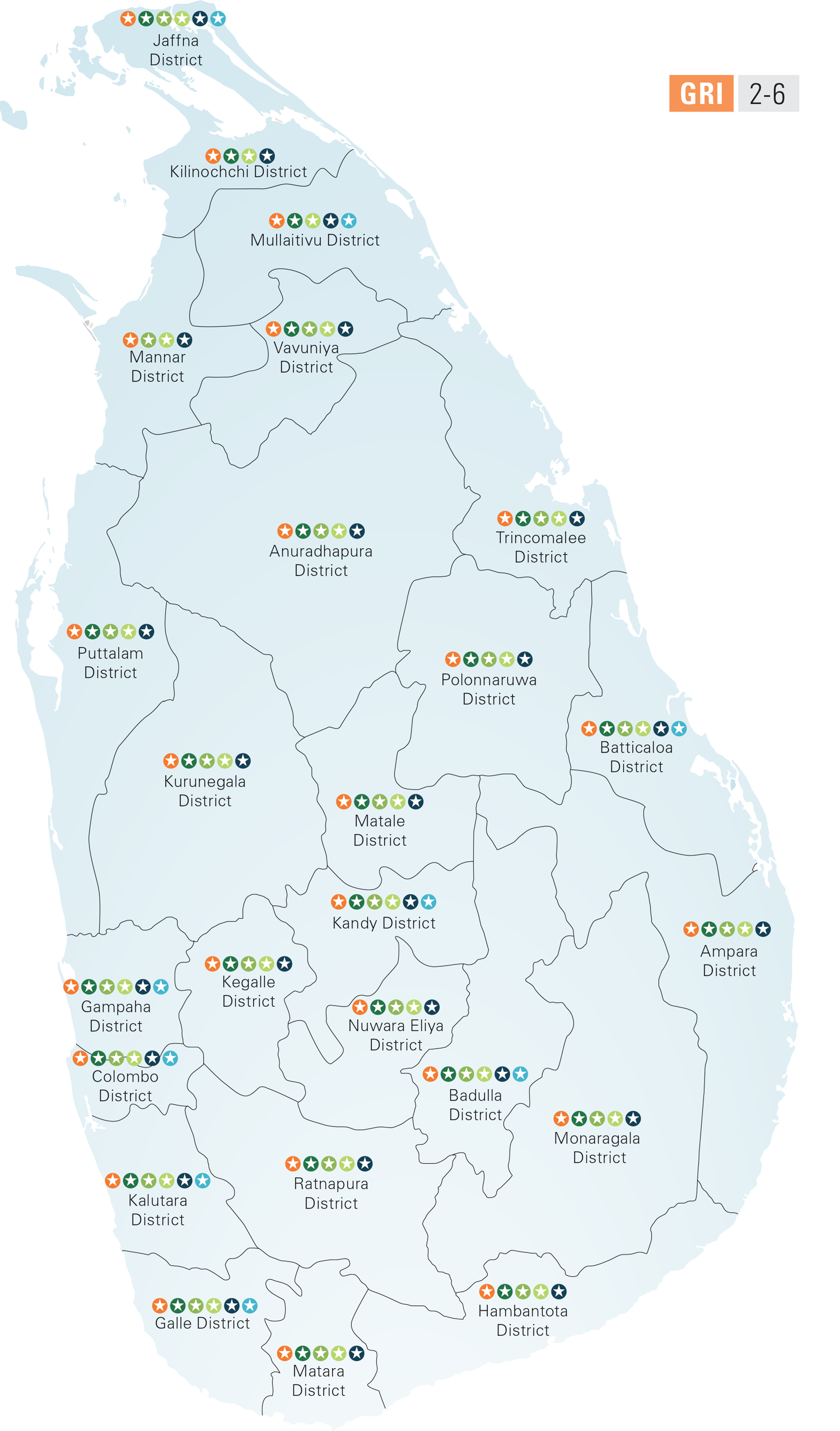

Customer Touch Points Distribution

| Province | District | Branches

|

ATMs

|

CRMs

|

CDMs

|

EBAs

|

DBCs

|

total |

|---|---|---|---|---|---|---|---|---|

| Northern | Mullaitivu | 1 | 1 | - | 1 | 3 | 1 | 7 |

| Vavuniya | 2 | 1 | 2 | 3 | 1 | - | 9 | |

| Mannar | 1 | - | 1 | 1 | 7 | - | 10 | |

| Kilinochchi | 1 | 1 | - | 1 | 2 | - | 5 | |

| Jaffna | 8 | 6 | 6 | 8 | 23 | 1 | 52 | |

| Central | Nuwara Eliya | 4 | 4 | 3 | 5 | 39 | - | 55 |

| Matale | 3 | 4 | 3 | 3 | 21 | - | 34 | |

| Kandy | 15 | 19 | 15 | 15 | 92 | 2 | 158 | |

| North Central | Polonnaruwa | 3 | 2 | 2 | 3 | 10 | - | 20 |

| Anuradhapura | 6 | 4 | 7 | 7 | 47 | - | 71 | |

| North Western | Puttalam | 8 | 8 | 8 | 6 | 11 | - | 41 |

| Kurunegala | 13 | 14 | 14 | 16 | 96 | - | 153 | |

| Eastern | Ampara | 7 | 7 | 5 | 10 | 23 | - | 52 |

| Batticaloa | 6 | 5 | 6 | 7 | 23 | 1 | 48 | |

| Trincomalee | 4 | 2 | 3 | 4 | 14 | - | 27 | |

| Uva | Badulla | 5 | 5 | 5 | 7 | 16 | 1 | 39 |

| Monaragala | 4 | 4 | 2 | 5 | 9 | - | 24 | |

| Sabaragamuwa | Ratnapura | 8 | 9 | 6 | 8 | 30 | - | 61 |

| Kegalle | 6 | 5 | 7 | 5 | 35 | - | 58 | |

| Western | Colombo | 63 | 82 | 111 | 70 | 207 | 17 | 550 |

| Gampaha | 27 | 39 | 47 | 24 | 191 | 5 | 333 | |

| Kalutara | 10 | 15 | 16 | 9 | 69 | 2 | 121 | |

| Southern | Hambantota | 6 | 5 | 7 | 2 | 14 | - | 34 |

| Galle | 10 | 8 | 12 | 6 | 177 | 2 | 215 | |

| Matara | 8 | 10 | 7 | 8 | 92 | - | 125 | |

| Total | 229 | 260 | 295 | 234 | 1,252 | 32 | 2,302 | |

Sampath Bank’s branch network consist of 229 fully-operational branches across 25 districts, of which 25 are in Bank-owned premises. The Bank is dedicated to enhancing operational efficiency and driving growth through sustainable practices. The Bank’s Corporate Sustainability Department plays a pivotal role in driving financial inclusion, ensuring that these initiatives reach local communities, further improving access to banking services nationwide.

Enhancing Efficiency through Innovation

To streamline branch operations, the Bank introduced middleware solutions to expedite the account opening processes. The LIME Solution was rolled out during the year for new savings accounts, which helped simplify the account opening mandate. The solution enables front office staff to input only five primary fields when opening accounts, while the remaining steps processed centrally, significantly reducing customer wait time. The Bank aims to roll out the solution to all other personal accounts including current accounts, fixed deposits and foreign currency accounts.

Moreover, two super branches were piloted during the year, offering services on extended hours and days. During the pilot period, the branches achieved faster processing times by referring detailed tasks to the newly-established Central Branch Operations Unit (CBOU), which was established in 2023. Account level modifications also took place during the year, allowing customer details to be updated across all operating systems with a single entry, further enhancing efficiency and accuracy.

SUSTAINABILITY INITIATIVES

As part of the ongoing initiatives, the 23 branches which are in owned premises have been converted to solar rooftops. For those branches which are rented, the Bank has transitioned to energy efficient lighting systems to further reduce its environmental footprint. The Bank’s ongoing digital transformation has also contributed to a year-on-year increase in digital transactions, resulting in fewer people visiting the branches and leading to a decrease in Scope 3 emissions.

What is LIME? LIME is a single login platform designed to support banks digitise and streamline their operations. The main goal is to enhance operational efficiency, deliver actionable insights and to provide a quick service for customers.

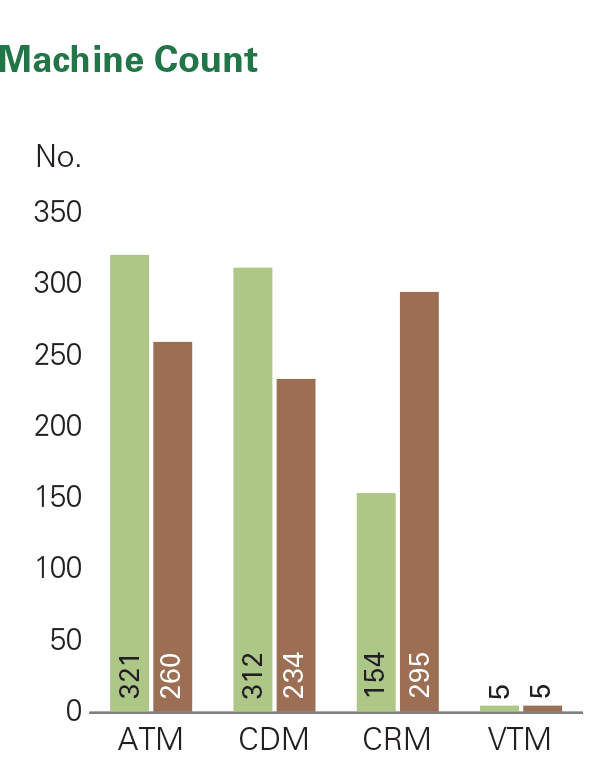

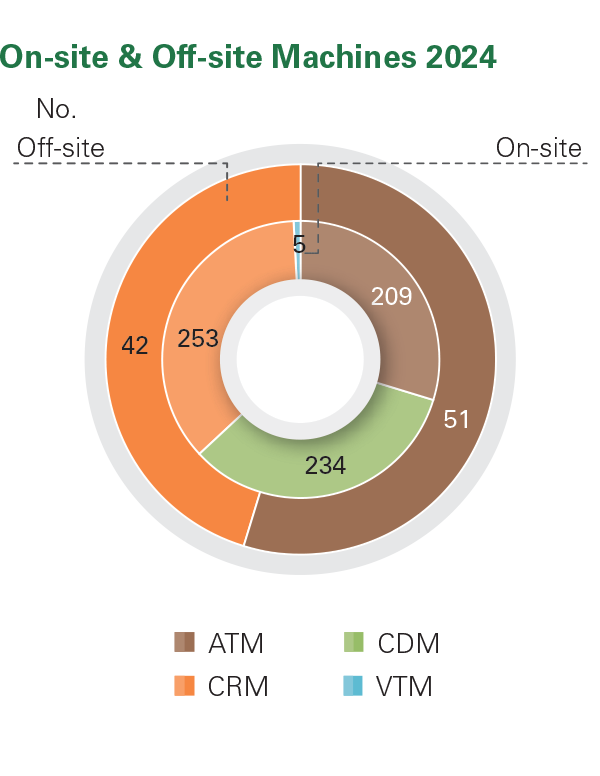

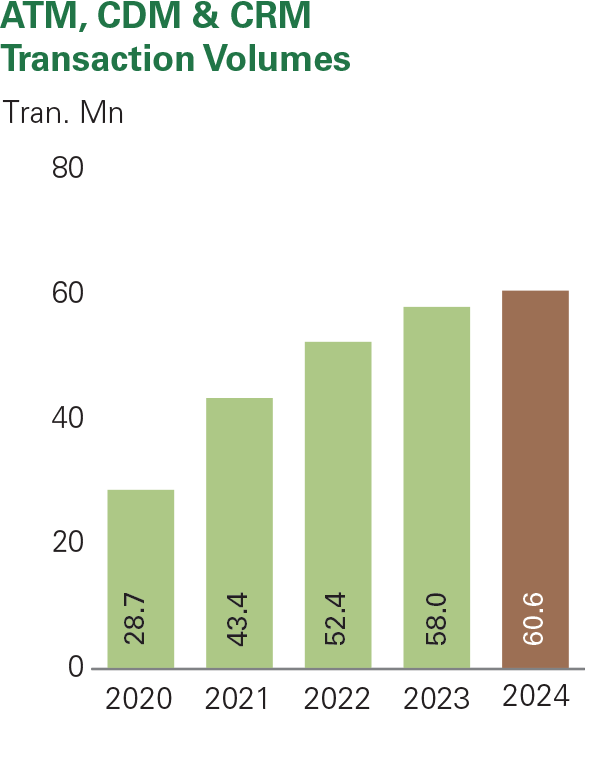

The Bank continues to advance its self-service banking infrastructure, enhancing customer experience and operational efficiency through a range of machines including Automated Teller Machines (ATMs), Cash Deposit Machines (CDMs), Cash Recycling Machines (CRMs), and next generation Virtual Teller Machines (VTMs). The Bank currently operates 260 teller machines, with a growing focus on CRMs and VTMs.

- 141 new CRM machines were installed in key locations including Gampaha Sumedha International School, Sri Lanka Institute of Information Technology (SLIIT) and Port City.

- 5 VTMs are operational, providing enhanced features for customer transactions.

OUTLOOK

- The Bank is dedicated to advancing technology and upgrading systems to enhance customer service and operational efficiency.

- The Bank will replace ATMs and CDMs with new CRMs, consolidating multiple banking functions into one machine. The new CRMs will offer services like cash withdrawals, deposits and recycling with biometric authentication and enhanced security, reducing wait times, increasing convenience, and improving transaction handling, especially during high-volume periods.